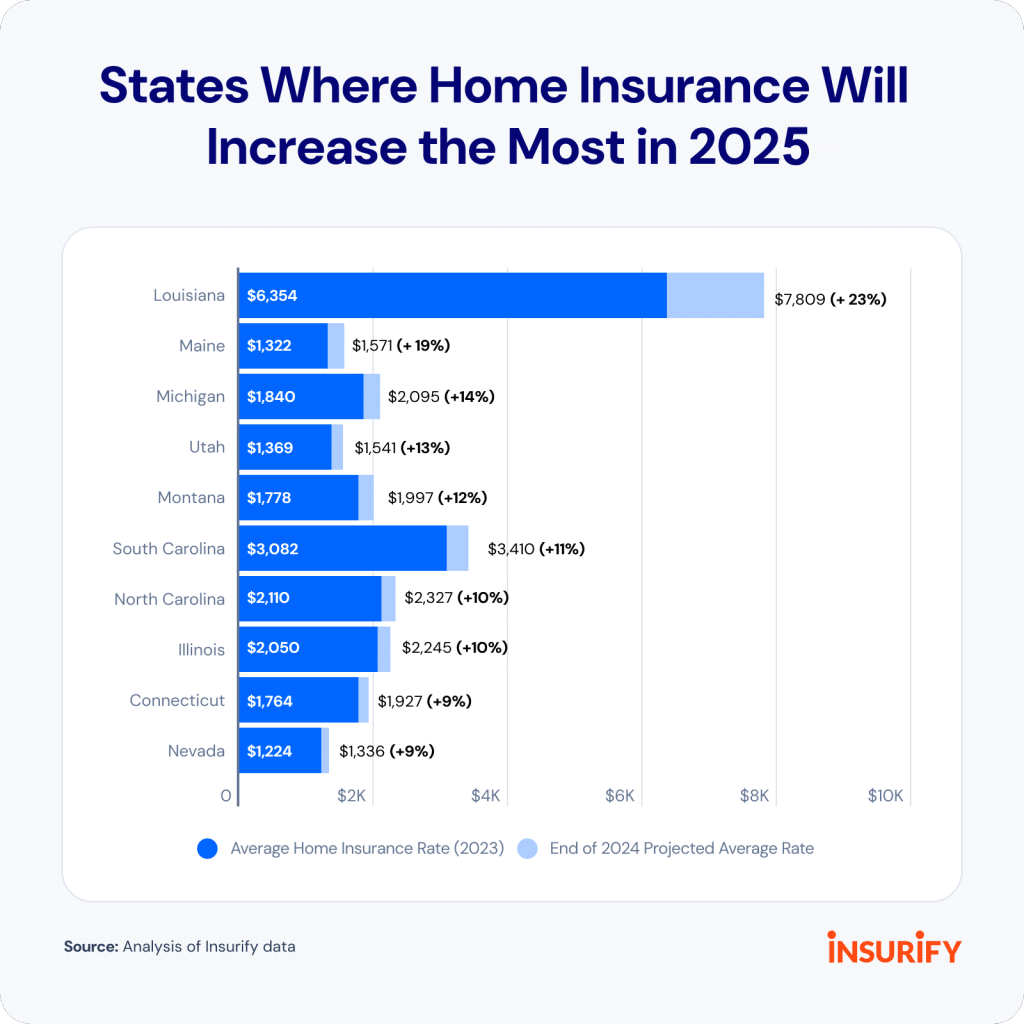

📈 Home Insurance Rates Are Surging in 2025

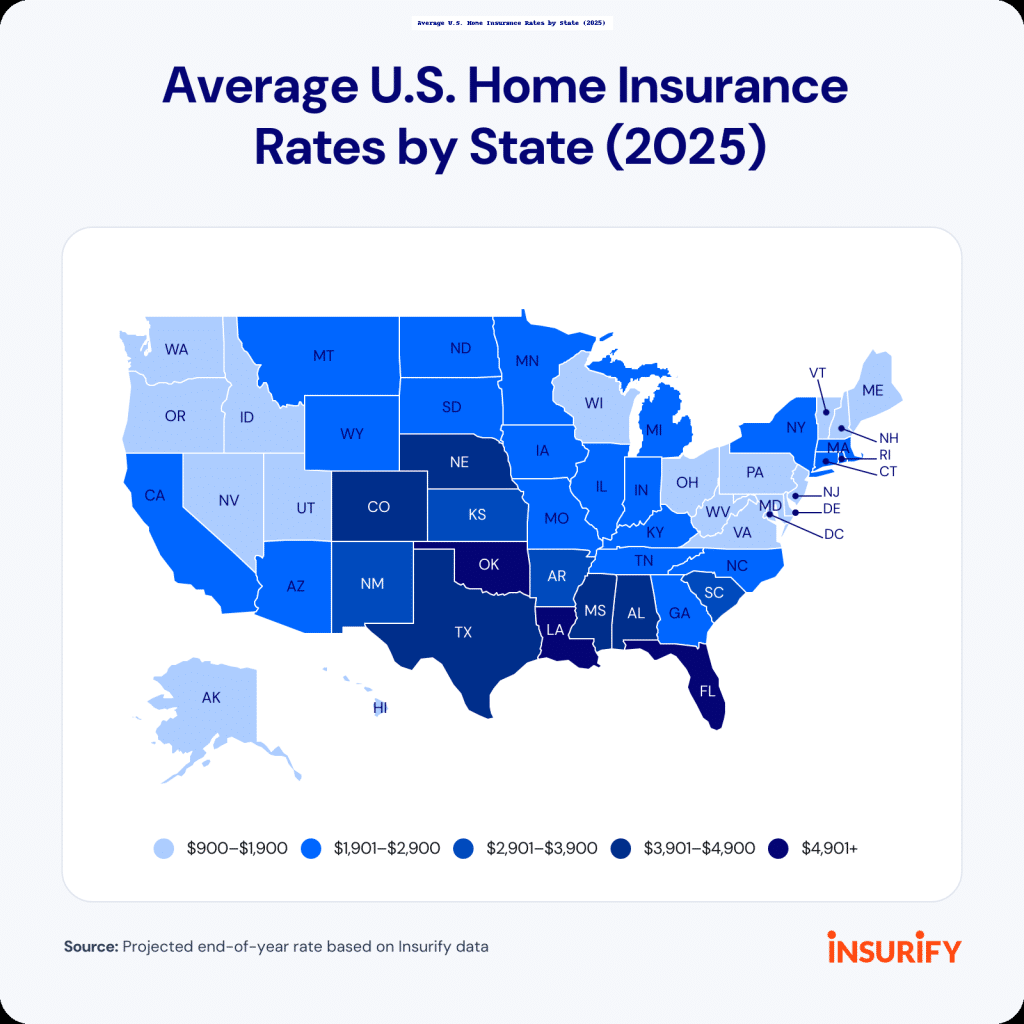

Homeowners across the U.S. are facing significant increases in insurance premiums. According to a 2024 analysis by Policygenius, home insurance prices rose by an average of 21% between May 2022 and May 2024, with some states experiencing even higher hikes. For instance, Florida homeowners saw an average premium increase of 35%, while Idaho and Colorado experienced increases of 31% and 30%, respectively.

These surges are attributed to factors such as increased natural disasters, higher construction costs, and a tightening reinsurance market.

Homeowners insurance premiums have experienced significant increases since May 2022, with national averages rising by approximately 20% to 30% over the past two years. These increases are largely driven by factors such as escalating natural disaster-related losses, inflation in construction materials and labor, and a tightening reinsurance market.

For instance, in Texas, homeowners insurance premiums surged by 43% since 2023, with an expected additional increase of approximately $500 in 2025. This spike is attributed to escalating natural disaster-related losses, mainly from hailstorms, hurricanes, floods, and fires exacerbated by climate change. Houston Chronicle

Similarly, homeowners in Tennessee have reported premium increases of up to 27% despite having no claims, highlighting the widespread nature of these hikes. MarketWatch

These rising costs are compounded by the fact that insurance premiums have been increasing faster than inflation. According to the U.S. Department of the Treasury, average homeowners insurance premiums per policy increased 8.7% faster than the rate of inflation between 2018 and 2022. U.S. Department of the Treasury+1Bankrate+1

In summary, homeowners across the U.S. are facing substantial increases in insurance premiums due to a combination of climate-related risks, inflation, and market dynamics. It’s advisable for homeowners to regularly review their insurance policies, explore potential discounts, and consider measures to mitigate risks to manage these rising costs effectively.

Additionally, the Insurance Information Institute reports that the average homeowners insurance premium rose by 7.6% in 2021 from the previous year, highlighting a continuing upward trend in insurance costs.

🚨 The Growing Risk Homeowners Didn’t See Coming

Across the U.S., millions of homeowners are being dropped by insurance companies—sometimes with little to no warning.

Why? In 2025, the insurance industry is shifting rapidly. Climate disasters, soaring claim costs, and insurer exits are creating a perfect storm. Even responsible homeowners are getting caught in the fallout.

If you’ve been dropped—or fear you might be next—here are five reasons why it’s happening, and exactly what you can do to stay covered.

🌪️ Reason #1: You Live in a High-Risk Area

Insurers are using advanced modeling tools to assess risk not just by property—but by ZIP code. Wildfires, hurricanes, and floods are pushing entire regions into high-risk status, causing mass policy cancellations.

What’s especially frustrating for homeowners is that you don’t need to live on the coastline or deep in the forest to be labeled “high-risk.” Insurers are using more granular data than ever before—down to the ZIP code, elevation, and even tree density—to assess the threat level of natural disasters. A property a few blocks from a wildfire buffer zone or just outside a 100-year floodplain can still be flagged. Some companies are even factoring in regional infrastructure, like access to fire hydrants or emergency response times. As a result, neighborhoods that were considered low-risk just five years ago are now facing limited coverage options, surging premiums, or flat-out denials.

🔥 High-Risk Zones in 2025

-

California wildland-urban interface (WUI) areas

-

Florida’s Gulf and Atlantic coastlines

-

Texas and Louisiana flood zones

-

Arizona, Colorado, and Oregon fire-prone counties

✅ What You Can Do

-

Request a Wildfire or Flood Risk Report on your property

-

Install fire-resistant roofing and clear vegetation (30 ft perimeter)

-

Ask about state FAIR Plan options if private carriers won’t cover you

-

Elevate key utilities (water heater, HVAC) in flood-prone zones

-

Bundle your home policy with auto or umbrella for loyalty retention

🛠️ Reason #2: Your Home Is Outdated or Poorly Maintained

Old roofs, outdated wiring, and neglected exteriors are red flags for insurers. Many companies conduct drone or satellite inspections and cancel policies based on what they find.

Outdated homes don’t just pose a greater risk of damage—they also cost more to repair, which raises red flags for underwriters. Insurance companies evaluate not just the age of your roof or wiring, but how well your home has kept up with modern safety standards and building codes. Homes with aging HVAC systems, single-pane windows, or deferred maintenance are more likely to generate costly claims. Even cosmetic signs of neglect—like peeling paint or overgrown vegetation—can lead to non-renewal after a drive-by inspection or aerial review. In many states, insurance providers now require proof of updates before they’ll issue or renew a policy, particularly in high-risk regions.

⚠️ Common Red Flags

-

Roof older than 20 years

-

Breaker panels from Zinsco or Federal Pacific

-

Visible stucco damage or peeling paint

-

Tree overhangs, debris, or drainage issues

✅ What You Can Do

-

Get a roof certification or professional inspection

-

Upgrade hazardous electrical components

-

Pressure wash and repair visible exterior issues

-

Document upgrades and send photos to your provider

-

Request a reinspection if improvements are made

🗄️Reason #3. You Filed Too Many Claims

Even valid insurance claims can work against you—especially if you file more than one within a short period. Most homeowners don’t realize that insurers track this behavior through a national database called the CLUE report (Comprehensive Loss Underwriting Exchange).

Not all claims are treated equally. While a single claim over several years may not trigger concern, filing two or more claims within a 3–5 year period—especially for water damage, mold, roof repairs, or liability—can be enough to label you high-risk. Among these, water-related claims are the most notorious for raising premiums, as they’re often seen as signs of ongoing structural or plumbing issues. Claims under $10,000 that repeat (e.g., multiple small roof or pipe leaks) are more damaging than one large claim from an isolated event like a fire. Some carriers will non-renew a policy after just two non-weather-related claims in five years, even if they were fully paid out. The more frequent and preventable the issue appears, the more likely your premiums will spike—or your policy will vanish altogether.

The CLUE report, maintained by LexisNexis, compiles up to seven years of your home’s insurance claim history, including:

- The type of claim filed (e.g., water damage, fire, theft)

- The amount paid out

- Dates of the claims

- Property address (yes, claims from previous owners can appear)

When your insurance company evaluates your renewal or a new provider assesses your quote, they almost always pull your CLUE report. If you’ve filed multiple claims—especially for water damage, mold, or liability—they may label your property as high-risk, even if the claims were fully valid. In many cases, this results in policy non-renewal or a significant premium hike.

And here’s the kicker: you may not even know what’s on your CLUE report unless you ask for it.

✅ What You Can Do

- Request a free copy of your CLUE report under the Fair Credit Reporting Act (FCRA)

- Review the report for errors or outdated claims

- Consider paying out-of-pocket for smaller repairs to avoid adding to your claims history

- Install leak detection or security systems to prevent the most common claim triggers

- Ask your agent how long past claims affect your eligibility with other carriers

References:

- LexisNexis CLUE Report Information

- Consumer Reports – What’s in a CLUE Report?

- III.org – Understanding Home Insurance Underwriting

🚫 Reason #4: Your Insurance Provider Is Leaving Your State

Big insurers like State Farm, Farmers, and Allstate are pulling out of high-risk states due to extreme losses and regulatory limits. Even loyal customers are being dropped.

According to a 2023 report from the American Property Casualty Insurance Association (APCIA), over 60% of insurers nationwide reported reducing coverage availability in at least one high-risk state. This trend has only intensified in 2024 and 2025. In California, major carriers like State Farm and Allstate have stopped writing new homeowners policies entirely, citing excessive wildfire losses and regulatory limits that prevent adequate rate increases. Meanwhile, Farmers Insurance pulled out of Florida, impacting more than 100,000 policyholders after sustained hurricane damage and rising litigation costs. Even in less headline-grabbing states, like Colorado and Louisiana, smaller regional insurers have gone insolvent or exited, leaving homeowners scrambling for FAIR Plan options. If your carrier is reducing exposure or leaving your ZIP code, you may be dropped even with no claims or infractions on your record.

🏃 States Most Affected in 2025

-

California – wildfires, rate caps

-

Florida – hurricane litigation and flood risk

-

Louisiana – insurer insolvencies

-

Texas & New York – coastal risk zones and market shrinkage

✅ What You Can Do

-

Ask your provider if they’re still underwriting in your ZIP code

-

Get quotes from independent agents with access to niche markets

-

Explore surplus lines carriers or non-admitted insurers

-

Apply to your state’s FAIR Plan as a last resort

-

Bundle or add umbrella coverage to increase your retention odds

References

🔍 Reason #5: You Failed an Insurance Inspection

Even if you’ve had a policy for years, a failed inspection can trigger immediate cancellation. Insurers now rely on aerial photos and AI tools to flag properties with poor upkeep.

Many homeowners don’t realize that insurance inspections have become far more sophisticated in recent years. Carriers are no longer relying solely on in-person visits—they’re leveraging satellite imagery, drone flyovers, and even AI-powered analytics to flag risks. A cracked driveway, cluttered backyard, or leaning fence could be interpreted as signs of poor maintenance, even if you’ve kept the home structurally sound. Some companies will issue a non-renewal without ever knocking on your door, simply based on visual cues pulled from public data sources or aerial scans. If you’re caught off guard, you may only have 30–60 days to make repairs—or face a full policy cancellation.

✅ What You Can Do

-

Perform a full exterior property check before renewal

-

Trim trees, remove debris, and repair broken fencing

-

Clean gutters, fix visible roof damage, repaint siding

-

Request a copy of any inspection reports used in your evaluation

-

Submit photo proof of completed repairs to your insurer

🧭 What to Do If You’ve Already Been Dropped

Getting dropped by your insurer can feel overwhelming—but it’s not the end of the road. The key is to act quickly and strategically. Start by securing temporary coverage through your state’s FAIR Plan or surplus lines market, even if it’s more expensive—this ensures you don’t lapse and risk mortgage violations. Then, begin improving your home’s insurability by documenting repairs, upgrades, or added safety features like security systems and leak detection. Keep a digital folder with before-and-after photos, inspection reports, and maintenance receipts. This kind of preparation not only helps you appeal denials but makes you far more attractive to alternative insurers or brokers willing to work with higher-risk properties.

If your policy has already been canceled or non-renewed, take action now:

-

📄 Request your CLUE report to review your risk profile

-

🔎 Use an independent broker to shop multiple insurers and or shop online

-

🛠️ Make any necessary upgrades to reduce future risk

-

📑 Apply for state FAIR Plan coverage if needed

- 🖼️ Keep detailed records and photo evidence of all improvements.

✅ Final Word: Prevention Is Protection

The 2025 homeowners insurance landscape isn’t just shifting—it’s unraveling in real time. From natural disasters to policy shakeups, millions of responsible homeowners are facing non-renewals, surprise cancellations, and skyrocketing premiums through no fault of their own. What was once a stable, reliable part of homeownership has become unpredictable and, in some areas, nearly inaccessible.

But here’s the good news: you’re not powerless. Whether you’re in a high-risk zone, living in an aging home, or just feeling uneasy about your insurer’s long-term commitment, there are proactive steps you can take today that may save you from being blindsided tomorrow. Small updates to your property, a review of your claims history, and strategic conversations with your insurance agent can dramatically improve your standing—and possibly your rates. And if your current provider is walking away? You have options. Independent brokers, regional carriers, surplus line insurers, and FAIR Plan programs are all lifelines that can keep you covered while you work to strengthen your property’s profile.

Don’t let a cancellation letter be the wake-up call. Take this information seriously, share it with other homeowners, and treat your insurance policy like a living document—something to manage, monitor, and maintain. In 2025 and beyond, staying insured isn’t just smart—it’s survival.